Year in Review: 2020 Exposes Gray Rhino Risks in China’s Financial Sector

Anything that occurred amid the Covid-19 pandemic could not be that shocking.

A crude oil investment product offered by a “Big Four” state-owned bank left domestic investors owing the bank money. Investing in bonds issued by state-owned enterprises (SOEs) was not as safe as it seemed. The would-be record IPO by Ant Group Co. Ltd. was halted dramatically at the last moment.

The three cases show how “gray rhinos,” or high-impact predictable threats that have long been neglected, have grown in China’s financial market and interacted with risk control mechanisms, investors and regulators in 2020.

Oil spill

Without effective risk controls, financial products can grow to become gray rhinos and external factors can leave market participants with a big problem.

In April, about 60,000 investors who bought a crude futures product sold by Bank of China Ltd. (BoC) suffered losses totaling some 10 billion yuan ($1.5 billion) after the collapse of global crude prices amid a pandemic-driven global slump in demand.

Read more

Four Things to Know About the ‘Paper Crude’ Futures Caught Up in the Collapse in Oil Prices

The product, known as “Yuan You Bao,” is a paper crude investment product for domestic retail investors, who in China are generally barred from directly investing in crude futures traded in foreign markets. There is no actual oil delivered in the end, with investors buying and selling security notes pegged to foreign crude futures, including West Texas Intermediate (WTI) futures, a major benchmark for global oil prices.

On April 20, the May WTI futures contract price fell below zero for the first time in history, settling at a record low of minus $37.63 per barrel. BoC was forced to sell its WTI futures position set to mature the same day at the negative price, leading to huge losses being passed on to investors.

Industry insiders and analysts have widely criticized the bank for risk disclosure and management failures and design flaws in the high-risk product sold to ordinary people.

CME Group started on April 15 to allow the WTI oil futures to be traded and settled at negative prices. However, the product design didn’t take negative value into account, and BoC failed to closely monitor market changes and suggest that clients cut their positions in a timely way. Meanwhile, the bank set its settlement date only one day before the monthly contract expiration, giving itself little flexibility to deal with potential price fluctuations.

It was a situation where the trading mechanism encountered an extreme development.

Read more

In Depth: A Bitter, $1.4 Billion Lesson on Commodity Price Speculation

Some industry experts also said products like Yuan You Bao shouldn’t have been sold to retail investors who can absorb only limited losses. Unlike global futures investors who trade oil contracts in thousands of barrels, investors in Chinese banks’ paper crude products can start with 0.1 barrel, which considerably lowers the threshold to enter the highly risky market.

Tens of thousands of customers who suffered huge losses on the speculative oil futures product could get a partial bailout from the bank, after a cabinet-level financial regulatory body publicly urged institutions to strengthen risk controls on investment products linked to international commodities.

In early December, the China Banking and Insurance Regulatory Commission (CBIRC) fined the bank and several senior executives and traders for failing to pressure-test the oil investment product, manage risks and adequately disclose information to investors, among other failures. The banking regulator’s announcement indicates that the bank was not fully aware of the risks of its product, violating rules from product development and management to sales.

SOE bond defaults

Since China launched a massive deleveraging campaign in 2015, privately owned companies’ credit risks have been relatively fully exposed. However, risks posed by SOE borrowings are a neglected threat.

Rather than seeing SOEs as safe bets due to their links to the state, Chinese investors are now losing their confidence to some extent in their creditability following the recent bond market turmoil.

State-owned coal miner Yongcheng Coal and Electricity Holding Group Co. Ltd.’s default on a 1 billion yuan bond on Nov. 10 sent shockwaves through China’s bond market, triggering selloffs of some SOE bonds and driving some companies to cancel planned bond issuances.

The Henan province-owned company’s default was particularly unexpected as it had received a AAA rating, the highest possible, from a domestic credit ratings agency just a month earlier. The company’s financial statements showed it had 47 billion yuan of cash at the end of September.

However, Yongcheng Coal did not have control over its money. Its parent company, Henan Energy and Chemical Industry Group Co. Ltd., regularly funneled funds out of its various subsidiaries, including the coal miner, sources told Caixin.

Read more

Cover Story: How SOE Default Wave Shows State Bailouts Are Over

The recent string of SOE defaults, including by an automaker linked to German car giant BMW AG, has eroded investors’ confidence in bonds issued by government-backed companies, particularly due to worries that they may default intentionally to dodge their debt.

China’s top financial regulator in November vowed to crack down on fraud in bond issuances, disclosure of false information, malicious transfer of assets, misappropriation of raised funds and debt dodging.

Credit ratings agencies also face challenges in figuring out how to rate SOEs and reflect risks in ratings when the government can’t provide any guarantees on repayment.

Ant Group IPO suspension

As leading Chinese fintech firms have grown into what the country’s financial regulators describe as “too big to fail,” policymakers are now tightening scrutiny over the giants and seeking to put them on an even playing field with traditional financial institutions.

Online lending titan Ant Group’s would-be record-breaking $34.5 billion IPO that blew up at the last minute may be the most outstanding example of regulators’ determination to deal with a fast-growing gray rhino which has posed a threat to financial stability.

Read more

Cover Story: Why Ant Group’s IPO May Stay on Ice for a While

The abrupt suspension followed an October speech from Ant Group’s ultimate controller Jack Ma in which he accused regulators of stifling innovation in the name of preventing risks.

Chinese authorities soon hit back with a slew of regulatory actions aimed at controlling risks arising from internet giants’ sprawling financial activities, including a draft regulation released by the central bank and the banking regulator in November that requires stricter standards for a range of online microlenders’ operational and financial metrics, such as their leverage levels.

The booming online microlending sector backed by fintech companies remains a key concern of regulators due to risks of excessive leverage.

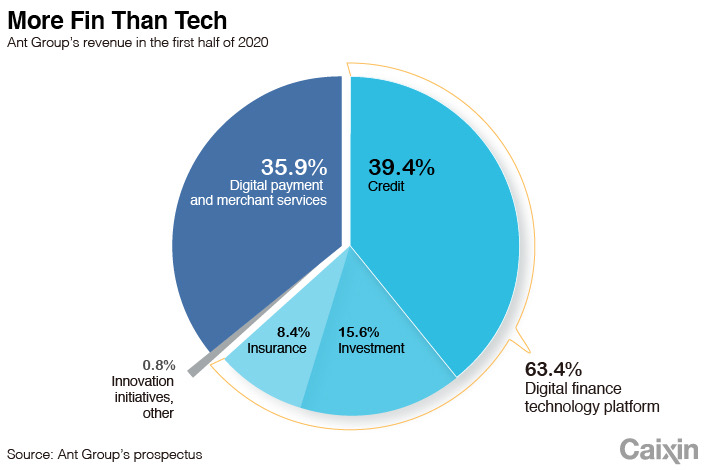

If the draft rules take effect, Ant Group’s business growth would be stymied as it relies heavily on its online lending business, which contributed nearly 40% of its total revenue in the first half of 2020.

|

The company is also facing pressure from new rules on financial holding companies effective on Nov. 1, which require it to come up with enough money to cover its capital reserves, creating a hurdle for its business expansion.

In recent years, Ant Group has repeatedly emphasized that it is tech-driven, even though its revenue has mainly been generated by its financial units. Its rapid expansion was largely due to its ability to sidestep some of the more stringent requirements for traditional financial institutions.

Rooted in the Alipay payment platform, Ant Group has grown into a juggernaut that owns the world’s largest payment service. Its full range of online financial services includes payment, banking, insurance, securities, wealth management, lending, corporate credit scoring and crowd funding.

Read more

Cover Story: How Ant Grew Into an Elephant-Sized Behemoth

“Some BigTechs operate cross-sector businesses, with financial and technology activities under one roof. It is necessary to closely follow the spillover of those complex risks,” CBIRC Chairman Guo Shuqing said in a December speech.

Ant Group’s business is also confronting greater headwinds as authorities toughen regulations to rein in monopolistic practices in internet goliaths’ economic activities and levy big fines against those who illegally handle personal information and data.

There is no clear timetable for when Ant Group will list. But one thing is almost certain — the company will face a severe haircut off its market valuation, as China is on the way to laying out a stricter regulatory framework.

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

This article is part of a 10-part series. You can find links to the others below.

Year in Review: China’s Economy Gets Back on Track, but Faces Long Road Ahead

Year in Review: Finance in China in a Word — Deleveraging

Year in Review: China’s Careful Exit From Pandemic’s Fiscal and Monetary Policy

Year in Review: China’s Financial Market in 2020 — More Opening, More Regulation

Year in Review: China’s Diplomacy in 2020 ― ‘Wolf Warriors’ in Action

Year in Review: Once Darlings, China Tech Giants Face Growing Scrutiny at Home and Abroad

Year in Review: The Year Covid-19 Changed Everything

Year in Review: Drive to Overturn Wrongful Convictions Gains Momentum

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR