CX Daily: Biggest Takeaways from The Opening of Two Sessions

China sets 2019 GDP growth target at 6% to 6.5%

China set its GDP growth target growth at a range between 6% and 6.5%, according to the government work report that Premier Li Keqiang delivered Tuesday at the opening of the annual session of the National People’s Congress.

The target falls in line with analysts’ expectations and is lower than last year’s goal of around 6.5%. The government last adopted a flexible GDP growth target in 2016, when it was set at a range of 6.5% to 7%.

|

This year’s growth target is also in line with the government’s goal of doubling 2010’s GDP by 2020, which requires average growth of 6.2% in 2019 and 2020. The government’s budget deficit in 2019 is expected to widen to 2.76 trillion yuan, or around 2.8% of GDP, Li said, from 2.6% in 2018.

Check out the other key announcements below, or click here to read our deep dive.

FINANCE & ECONOMICS

|

A tax counter in northwest China's Gansu Province. Photo: VCG |

Tax cuts /

China is cutting taxes, fees by 2 trillion yuan

To bolster growth, the government pledged a package of 2 trillion yuan ($298.31 billion) of tax and fee cuts, focusing primarily on reducing burdens in manufacturing and on small and micro businesses. The measures include cutting the VAT rate for manufacturers from 16% to 13% in 2019 and slashing the VAT rate for the transportation and construction sectors from 10% to 9%.

The package exceeds market expectations. Analysts had broadly expected tax and fee cuts for 2019 to reduce business costs by between 1.3 trillion yuan and 1.5 trillion yuan. One economist suggested the VAT cut for manufacturers will reduce companies’ tax payments by 520 billion yuan.

Infrastructure /

China plans to invest $120 billion in rail this year

Also announced were plans to invest 800 billion yuan ($119.38 billion) in railway projects this year, marginally less than the actual sum spent last year but nearly 10% more than last year’s target.

Spending on road and water transportation will total 1.8 trillion yuan, along with a batch of key projects in logistics, civil aviation and information infrastructure. The government will also boost infrastructure financing with 2.15 trillion yuan of local government special purpose bonds to support key projects.

Local debt /

China continues debt-for-bond swaps for local governments

Furthermore, China will continue to swap local governments’ unofficial liabilities for government bonds this year to give them more financial breathing room as economic growth is expected to continue slowing, according to the annual report.

Weaker economic growth is set to squeeze the income growth of debt-laden local governments at a time when they have to spend more to drive investment in support of expansion.

Takeaways /

Few surprises, save for stronger-than-expected fiscal stimulus

While unsurprising, China's revised GDP growth target confirms that it will not attempt a massive stimulus this year – good news for those fearing a return of the splashy debt-driven stimulus model of 2009. Our other takeaways:

• Monetary policy is not set to loosen significantly overall.

• A benchmark interest rate cut this year, the first since 2015, appears likely.

• Financing not reaching the real economy is a clear concern.

• Fiscal stimulus measures announced were stronger than expected.

• Lower tax revenue puts more constraints on infrastructure spending.

• Reduced social security contribution ratios should lift pressure on companies.

• Jobs may be hit by slower growth.

Read our full analysis.

Economy /

China’s services sector slows: Caixin survey

Expansion in China’s services industries continued to moderate in February as new business growth dipped to a four-month low, a Caixin survey showed Tuesday.

The Caixin China General Services Business Activity Index, which provides a snapshot of operating conditions in the country’s services sector, dipped to 51.1 in February from 53.6 in January. A reading above 50 indicates expansion, while anything below that points to contraction. The reading marks the lowest growth in the services sector since October.

Quick hits /

• Will China cut its benchmark interest rate?

• Whither M2? Money supply target falls out of favor

• New supply-side reform to focus on private firms: Banking regulator

• Editorial: China needs all hands on deck for monetary reform

• China’s most ubiquitous bank gets new chairman

BUSINESS & TECH

|

Robots build car door locks on an assembly line in Suzhou, in Jiangsu province, Sept 2, 2018. Photo: VCG |

Two Sessions /

China wants to tap AI to elevate manufacturing

China's government wants to use AI to advance the “quality development of the manufacturing industry ... to accelerate China into a manufacturing powerhouse,” according to Premier Li Keqiang's annual work report.

China has previously set sights on tapping AI to upgrade health care, elderly care, education, culture and sports and wants to become a world leader in the field by 2030. Beijing is said to be launching around 400 major subjects at universities related to AI, big data and robotics this year.

Cybersecurity /

Tech tycoon calls for digital ‘national defense system’

Rather than corporations, network operators and the government maintaining separate systems to defend against cyberattacks, China should develop something akin to a "national-level cybersecurity brain,” Zhou Hongyi, founder and CEO of cybersecurity company Qihoo 360 told the CPPCC Tuesday.

The tech tycoon cautioned that as AI and IoT develop and more devices connect, attack vectors are increasing, possibly into the trillions. A national defense system could use security-oriented big data to prevent attacks.

Communal use /

Sharing economy grew more than 40% last year

|

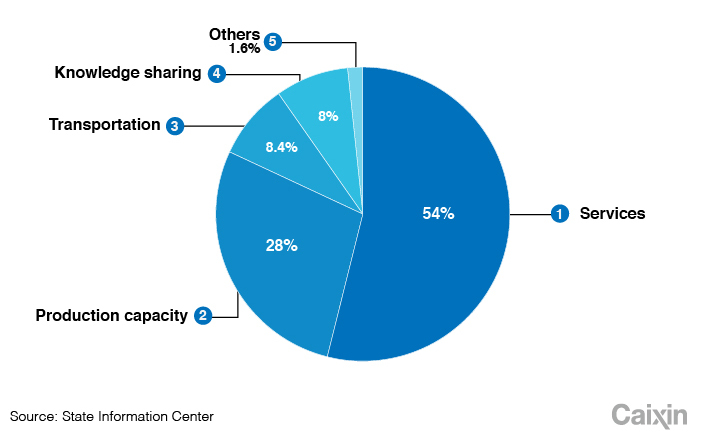

China’s sharing economy was worth 2.94 trillion yuan ($440 billion) last year, up 41.6% YOY, according to a new report. Much of the increase was driven by the rapid growth of production capacity sharing, which was up 97.5% to 823.6 billion yuan and accounted for 28% of the total.

Backlog /

China Customs holds 1,600 Teslas

Shanghai Customs is holding the brand’s Model 3 cars after some vehicles had no Chinese labels on brake fluid tanks, while others demonstrated a real motor capacity that differed from the one on the label.

As a result, Customs issued a notice forbidding companies from selling any Tesla Model 3s already in China, for the purpose of further inspection. Any additional Tesla models entering China will also be rigorously checked. Tesla blamed “incorrect settings on its printers” and “workers’ poor operation.”

Real estate /

After cash splash, mainland property developers flounder in Hong Kong

Mainland developers stormed into Hong Kong in 2016 and 2017, solely or jointly acquiring nearly 40% of the parcels of residential land that were put out for public tender. But the numbers dropped significantly last year, when they acquired only three of 11 pieces of residential land on the auction block — compared with seven of 10 in 2017.

Changing conditions, namely less liquidity amid tighter financing regulations and subdued sales at home, have left Chinese mainland property developers struggling to expand in Hong Kong, analysts say. Check out our in-depth look.

Quick hits /

• Cathay Pacific in talks to buy budget carrier Hong Kong Express

• 5G stocks soar after China’s congress emphasizes sector’s importance

• 5G hype fails to buoy China’s cellular tower operator

• World’s largest coal production company appoints new head

• Soon you'll be able to keep your phone number when you change carriers

• China targets 10% reduction in industrial electricity costs

Thanks for reading. If you haven't already, click here to subscribe.

- 1Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 2In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 5Over Half of China’s Provinces Cut Revenue Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas